We have a solid asset base and a pipeline of projects spread across the Americas.

Hochschild aims to invest in mineralised districts with the possibility to grow over time. We have a long and successful track record of discovering low-cost resource additions and are currently executing a comprehensive programme at all our deposits across Peru, Argentina and Brazil. We believe that there are significant further opportunities to extend the lives of our mines and projects and improve the quality of our resources.

|

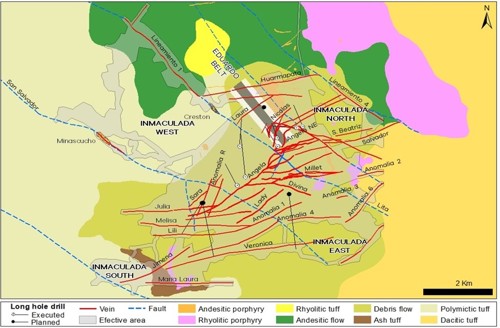

InmaculadaDuring the first quarter of the year, the team carried out 4,051m of drilling for potential in the Tesoro, Nicolas, Andrea, Josefa, Rita, Split Josefa, Laura, and Split JNE vein structures with the key results coming from the Tesoro and Nicolas veins.

In the second quarter, the Company expects to complete five remaining drill holes (approximately 2,500m of drilling) before commencing 11,000m of resource drilling in the Tesoro and Nicolas veins. |

|

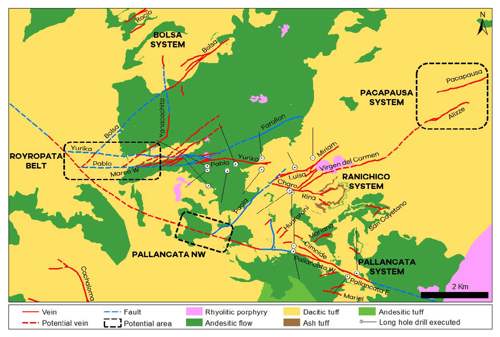

RoyropataAlthough it is outside the permitted area and will require approximately three years to receive the necessary government approvals, the size of the resource is already over 700,000 gold equivalent ounces with significant exploration upside. We are confident that this new zone will be the future of mining in the area in the medium to long term, despite the recent necessity to place Pallancata on temporary care and maintenance.

The existing discovery is expected to continue to grow with the Company targeting a doubling of resources of similar quality. The key metrics for the existing resources are detailed on this page, to the right. |

|

San JoseIn 2023, the brownfield team at San Jose carried out 906m of potential drilling and 4,420m of resource drilling in the Suspiro, Sigmoid Molle, Guadaluoe veins with the key vein expected to be the Suspira quartz sulphide vein which has high silver grades. The plan for the first quarter of 2024 is to perform 1,500m of potential drilling at San Jose in the Telken North and Cerro Saavedra areas. |

Our strategy with regards to our greenfield exploration programme is to maintain and drill a balanced portfolio of early-stage to advanced opportunities using a combination of earn-in joint ventures, private placements with junior exploration companies and the staking of properties.